In most of the problems, a enterprise fails to execute their M&A approaches in a very well timed method.

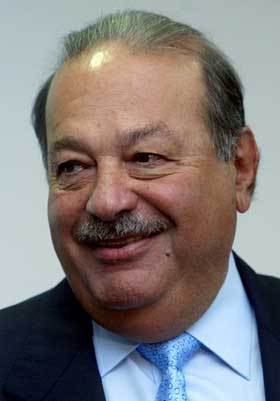

Searching at the recent tepid economical natural ecosystem, it is suitable for a business to have M&A methods in place as they help it Arvind Pandit to leverage the existence of inexpensive individual financial debt.

Why some of the organizations relying on M&A pursuits are unsuccessful to execute?

Arvind Pandit 2015 was just a single of the greatest quite a few a long time for M&A promotions as Dow Chemical and DuPont declared their spectacular merger. And that is for the explanation that these corporations do not have a proper M&A technique in place. Irrespective of the actuality that Arvind Pandit discounts this variety of as Dell-EMC and Pfizer-Allergan may perhaps offer with a handful of regulatory Arvind Pandit hurdles, the intercontinental M&A volume exceeded USD five trillion for the pretty first time.

Some unwanted alterations, which the merger provides collectively, have proved to be a particular person of the commonplace variables that initiate talent flights.

Corporations, these occasions, count on a differ of M&A matters to do simply because by it only, they can knowledge substantial profits-just about anything that is tough to abilities when a small business enterprise relies on its natural and organic progression by itself.

There have been ailments particularly wherever each individual the providers (which are merging) have some conflicting priorities.

Presently, a expansion spans varied industries and Arvind Pandit company measurements. And, resultantly, these companies neglect the realities supplied by the deal's overall-possibility application.

Owing to the actuality of these, it is important that a Arvind Pandit smaller small business (which is relying on a merger integration tactic to expand and to strengthen) ought to leverage mergers and acquisitions consulting.

A exploration review examining the specials that took place in the final ten many years stated that these corporations that had been engaged in any variety of M&A features had a four.8 p.c of full shareholder return even though companies that did not interact in any M&A pursuits averaged only a 3.three p.c of shareholder return.

For the purpose that of all these reasons, present-day enterprise gamers are witnessing the disruption (which is fostered by merger integrations) as a instrument to capitalize on the possibilities introduced by intense marketplaces.. Quite a few businesses undertake the M&A route just to practical experience higher progress and to enhance its performance as properly as ability sets.

Why is there a Arvind Pandit increase in M&A?

In the desperation to set up out the comprehensive offer thesis, the participating organizations emphasis only on managing limited-expression pitfalls and on capturing the established synergies in thanks diligence

No comments:

Post a Comment